India is on the brink of becoming a global powerhouse in aerospace manufacturing. What challenges do we face in manufacturing our own commercial planes?

While India has made strides, our share in the global aerospace supply chain is still under 1%. To manufacture commercial planes, we need to shift from components to major assemblies and systems. Acquiring sensitive technologies in aerostructures, avionics, and landing systems is crucial. The Airbus-Tata C295 and Helicopter Final Assembly Line (FAL) projects are positive steps toward building the necessary ecosystem for a commercial aircraft FAL in India.

How do you view the evolution of the “Make in India” initiative in the aerospace sector against global competition?

India is well-positioned to capture a significant share of the aerospace supply chain. The challenges faced by legacy supply chains in Western countries, combined with geopolitical shifts away from China, make India more attractive to major OEMs. Companies like Collins, Safran, and Honeywell now see India as a serious contender.

What technological and infrastructural gaps must be addressed to propel India to the forefront of aerospace manufacturing?

Critical IP is still held by top OEMs, and Indian design capabilities are maturing. We operate largely in the Build-to-Print space. Infrastructure has improved, but we need to focus on developing skilled manpower. The recent budget’s emphasis on vocational training and formalizing employment is a positive step for the sector.

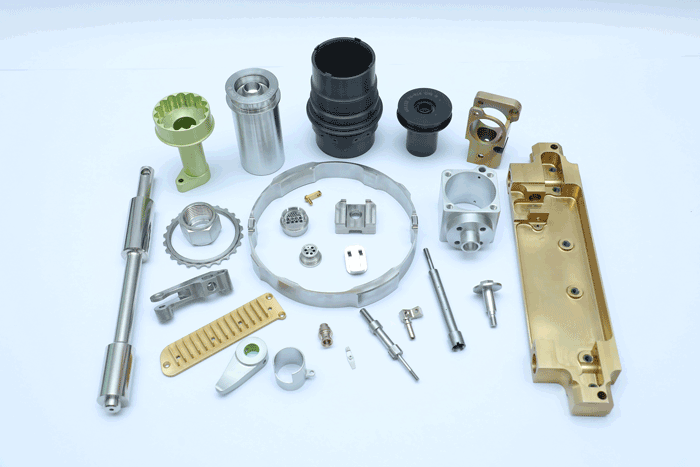

JJG Machining Group has integrated nearly 98% locally sourced raw materials in production. Can you elaborate on this achievement?

In our automotive division, 98% of raw materials are sourced locally. However, in aerospace, it’s currently under 5%. We expect this to rise as Indian steel and aluminium mills receive the necessary approvals for greater local integration in aerospace production.

What challenges did you face in reducing dependence on imports, and how did you overcome them?

The stringent approval processes from OEMs for raw materials posed challenges. We collaborated with Indian suppliers to help them meet global standards and worked closely with OEMs to ensure compliance, leading to increased local sourcing, especially in automotive.

How important is sustainability for the growth of the aerospace sector in India, and what role does JJG play in this transformation?

Sustainability is crucial. Sustainable Aviation Fuels (SAFs) are emerging but face cost barriers. JJG is committed to adopting the UN Climate goals and is making strides toward reducing emissions and enhancing sustainability across our operations.

How have partnerships with global giants like Boeing and Collins Aerospace influenced JJG’s growth?

Our collaborations with these giants have been vital for growth and technological advancements. They have enabled us to move up the value chain, allowing us to handle more complex parts and enhancing our capabilities in machining and metal finishing.

As India moves closer to becoming a leader in aerospace manufacturing, what role do startups play in this transformation?

Startups and innovation hubs will be significant, especially in defense. Initiatives like iDEX foster collaboration with smaller companies. However, in commercial aerospace, established players will continue to dominate due to the complexity of systems.

What advice would you give aspiring entrepreneurs in aerospace manufacturing?

Patience is key, as aerospace is a long-gestation business. Maintaining high standards and compliance is non-negotiable. Building strong relationships with stakeholders and focusing on innovation in high-precision manufacturing will set you apart in this competitive field.